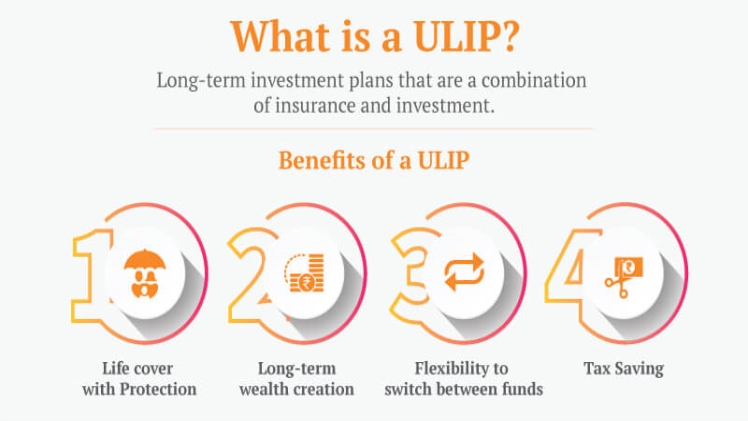

Things to know about ULIP

A unit-linked insurance plan (ULIP) is a type of life insurance policy that provides the benefits of investments along with insurance that will protect your family if there is an unfortunate event. The premium is split in two. A part will be paid towards the investment of your choice be it debt or equity, and the other part will be paid towards your life cover. It is used to achieve long-term goals like education of children and a retirement.

A ULIP plan can also be used as a tax-saving option. The agile model of ULIP has resulted in many customers opting for this plan. However, there are some things you need to know before you invest in a ULIP plan.

Things to know about a ULIP

- Flexible Investment Option

A ULIP plan provides the unique opportunity to invest your money in either equities or debts as per your choosing. So, if you like to take risks, then ULIP plans can be a perfect option for you.

- Tax Saving Benefits

A ULIP plan also provides a tax-saving benefit, as it falls under Section 80C of the Income Tax Act. When the plan matures, and you get the final sum, that is also tax deductible. - Lock-In Period

There is a lock-in period with ULIPs. This means that the customer must regularly pay money till the lock-in period. This can be a boon as it ensures that the money is being saved and regular investments are made. - A Better Option for Long-Term Goals

It is a perfect plan if you are planning a long-term goal such as retirement and children’s education. It also ensures that the money stays in the market during the lock-in period, thereby making it more stable and providing more growth as the market rises. Click here for more about free fire unlimited diamonds technical - Different Payment Methods

A ULIP plan offers multiple methods to make payments. Such as a single payment method, which is a lump sum amount that you pay right at the start, or a regular payment option where a certain amount is paid throughout the life of the plan. Also, there is an option of a limited sum plan where you pay an amount for a certain period.

- Flexibility With Your Life Cover

ULIP plans provide you with an option to increase your sum assured on the life cover of your choosing over the term of the plan. It can be very beneficial if you can afford more investments as you grow with age.

- ULIP Charges

There are some charges that may be applicable to you, such as fund management charges and administration charges. You need to know about these charges before you invest in it. - Partial Withdrawals

A ULIP provides a unique option that facilitates a partial withdrawal. This means that you can withdraw your money for your financial need, and it will not affect the continuity of the plan. Note that this can only be done after the lock-in period is completed.

In conclusion, ULIPS provides your family with a unique option of investing in the market in the funds of your own choice and life cover.